High Net Worth Families

At Bent Tree Trust Advisors, we serve multigenerational families who want to maximize wealth transfer and minimize taxes using innovative trusts and estate planning strategies. We have found through the years that often even CPAs and estate planning attorneys don’t know about specific trusts that can minimize or even eliminate capital gains or estate taxes. This piece of the tax mitigation puzzle can make a huge difference when it comes to your family’s wealth now and through the generations. We bring all of the heirs and stakeholders into the planning stage early so they understand the big picture.

”We’ve found innovative ways to help protect you from capital gains and/or estate inheritance taxes in certain instances using specific trusts.”

— Collin LaFollette

Are we a fit for you? Let’s find out!

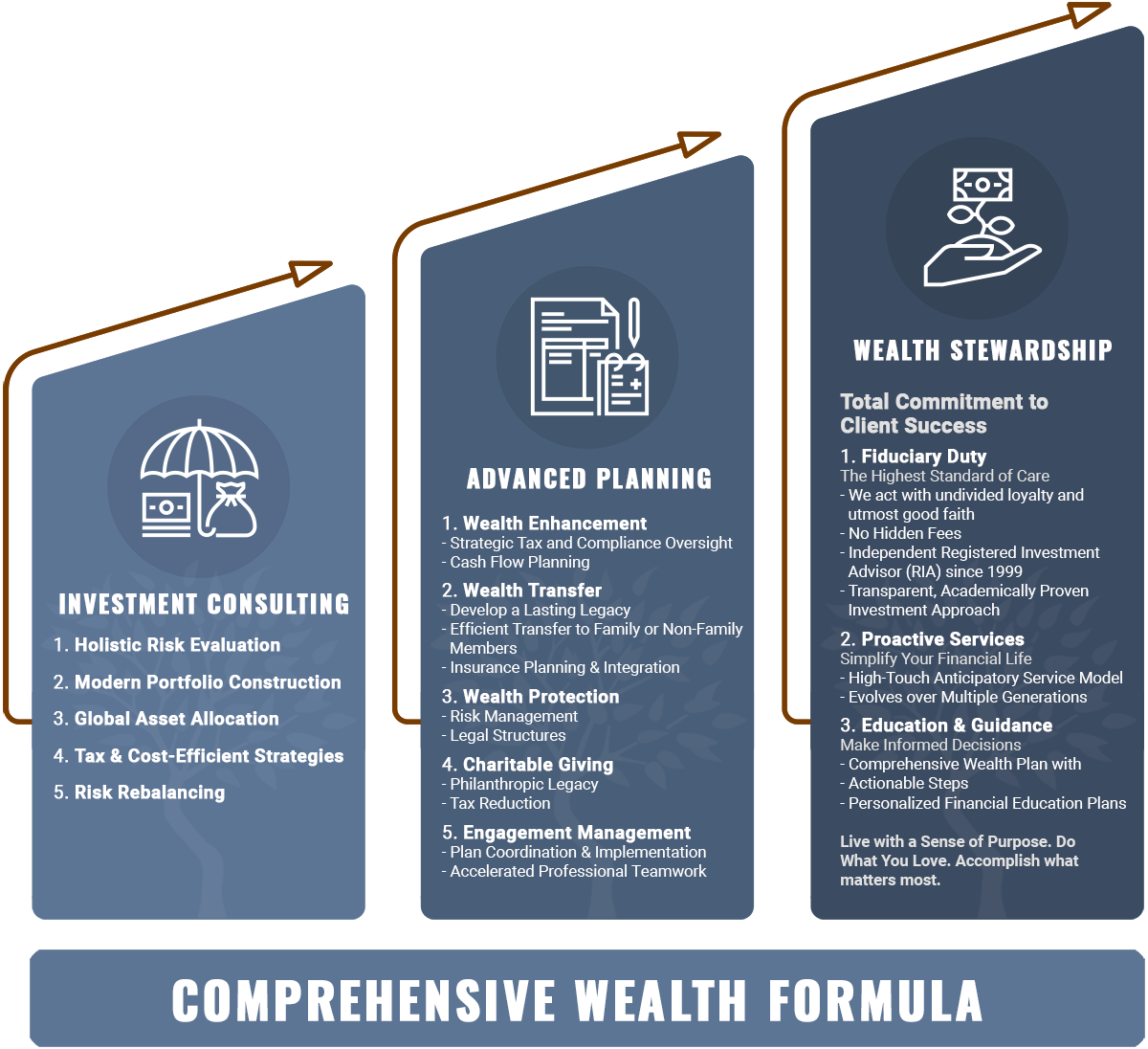

Investment Consulting

1. Holistic Risk Evaluation

2. Modern Portfolio Construction

3. Global Asset Allocation

4. Tax & Cost-Efficient Strategies

5. Risk Rebalancing

Advanced Planning

1. Wealth Enhancement

- Strategic Tax and Compliance Oversight

- Cash Flow Planning

2. Wealth Transfer

- Develop a Lasting Legacy

- Efficient Transfer to Family or Non-Family Members

- Insurance Planning & Integration

3. Wealth Protection

- Risk Management

- Legal Structures

4. Charitable Giving

- Philanthropic Legacy

- Tax Reduction

5. Engagement Management

- Plan Coordination & Implementation

- Accelerated Professional Teamwork

Wealth Stewardship

Total Commitment to Client Success

1. Fiduciary Duty

- We act with undivided loyalty and utmost good faith

- No Hidden Fees

- Independent Registered Investment Advisor (RIA) since 1999

- Transparent, Academically Proven Investment Approach

2. Proactive Services

- High-Touch Anticipatory Service Model

- Evolves over Multiple Generations

3. Education & Guidance

- Comprehensive Wealth Plan with Actionable Steps

- Personalized Financial Education Plans

- Live with a Sense of Purpose. Do What You Love. Accomplish what matters most

Fee-Based Fiduciary Services

As a fee-based fiduciary financial advisory firm, we collaborate and coordinate all the various advisors and disciplines to help ensure that everything gets communicated. We also work with your CPAs to help ensure that your tax return is done accurately every year, while looking ahead to reduce taxable income in the future. The kind of work we do takes time and a lot of analysis, but we are dedicated to our clients for the long haul. Our clients and their family members become our personal friends, and our goal is that there are no surprises. There is complete transparency about all fees, anticipated returns, and costs.

How to Get Started with Bent Tree Trust Advisors

We want our first meeting with you to be as productive as possible and want you to receive beneficial information even if at the end of the meeting we decide we are not a good fit to work together. The first meeting is designed to be exploratory, and it’s complimentary. That said, the more we learn about you and your situation, the better we may be able to assess whether or not we can help you save money on taxes and grow your wealth now and for future generations.

Bent Tree Trust Advisors

3008 Holford Road

Richardson, TX 75082-3741

P: (972) 591-7002

F: (855) 743-4246

collin@benttreetrust.com