”Taking the time necessary to explain advanced planning concepts so that clients can easily understand them is one of my gifts.”

— Collin LaFollette

With more than 30 years of experience in the financial services industry, Collin LaFollette founded Bent Tree Trust Advisors as a registered RIA (registered investment advisory) firm in 1996. At that time, he had already been working in the field for several years. In fact, he had become an IAR (investment advisor representative) back when there were very few in the industry—many financial professionals worked as brokers. Collin wanted to do things differently from anything he’d seen before, so he started his own firm.

“I became an entrepreneur and formed my own independent RIA firm because I was disenchanted with what seemed to be an industry of ‘salespeople’ who weren’t necessarily transparent or completely truthful about what they were selling. Financial advice should be just that: Advice. Not someone trying to use the latest sales techniques to influence someone. I wanted to include more services. I wanted to disclose all fees, commissions and examine the costs of every investment. I wanted to help mitigate the tax ramifications. Our firm functions as a fee-based, fiduciary firm with a legal duty to do what is in the client’s best interest at all times, and as an independent firm, Bent Tree Trust Advisors has access to hundreds of strategies and we can take a completely unbiased approach. We answer to no one except our clients,” Collin says.

Bent Tree Trust Advisors handles investments and assets under management (AUM) using third party custodians which Collin feels is an important layer of protection for clients. “Your money is held in your account in your name and can only be withdrawn by you. As an RIA, we cannot make commissions on equity trades. In fact, we disclose all forms of compensation with complete transparency. People are sometimes surprised when they learn that even inside so-called “no-load” mutual funds, there might be a lot of trading going on inside the fund. This doesn’t help performance, in fact, quite the opposite. It lowers their overall return. We look closely at everything when we work together,” he says. “Furthermore, when it comes to investments, being fee-based means we can only earn more when you earn more. Brokers can have a conflict of interest because they make a commission each time there’s a stock market trade. We are deliberately structured differently,” he says.

But the thing that makes Bent Trust Advisors really unique is that they combine financial planning, innovative and little-known tax strategies, and advanced estate planning techniques together to help clients in a truly comprehensive fashion. “It’s really important that all disciplines work together—your estate attorney, CPA, financial advisor, property & casualty agent, investments, and life insurance—in order to build, protect, and retain the most wealth possible for both the short and long term,” Collin says.

Collin has a keen interest in doing more than just investing for clients, so he made it a point to learn more about tax planning so that he could team up with CPAs. “A lot of advisors say they do tax planning, but we seek to implement tax solutions. For instance, before you retire, many advisors suggest you do a series of Roth conversions—converting taxable to non-taxable funds. That’s fantastic, paying no taxes during retirement is a great idea. But unfortunately, those Roth conversions create taxable events in each year that you do them. So why not find a solution to mitigate those taxes, too? We did find a way to do this. In fact, that’s the sort of thing we do that few other firms offer,” Collin says.

One of the things Collin really enjoys is getting introduced and then working closely with CPAs and estate attorneys to implement perfectly legal strategies but little-known like certain trusts he’s found that can help clients save money on taxes now, and on long-term capital gains or estate taxes for the long-term. He pursued and earned his CEP® (certified estate planner) designation so that he could learn more about the ways people can pass on more tax-advantaged wealth to their chosen beneficiaries or charities while mitigating taxes.

See Collin’s CEP designation here: https://nicep.org/profile/collin-d-lafollette-id-556

“I enjoy coordinating all the disciplines. I help tax professionals get trust returns and Schedule A information, along with other information they need to do their jobs every year. And we work with estate attorneys so that they can complete accurate trust documents,” he says. “We also look ahead to find ways to reduce taxes in the future.”

As Collin puts it, “The kind of work we do takes time and a lot of analysis. I’m dedicated to clients for the long haul and I have a long-term focus. But it all starts with listening. I try to listen rather than talk. I have to know a lot in order to put everything together, and I need to see statements and tax returns.” (Learn more about How to Get Started with Bent Tree Trust Advisors.)

“Customized and thorough planning requires that I understand the complete picture. I realize some people are uncomfortable with that at first, before they actually know me, but we want to truly serve your best interests. Other advisors may just be out to sell you something—that’s not our approach. Growing assets, saving on taxes, and protecting money properly requires a lot of data. Don’t bring your checkbook; financial planning isn’t about a transaction or purchase—it’s about creating a comprehensive plan with investment, tax and estate strategies that make sense for you.”

Collin comes from a family of educators, so explaining the “why” behind financial strategies comes very naturally to him. “I want you to know what you are doing,” he says. “I like to make things easy to understand, whether it’s investing properly, using charitable trusts, creating a plan for long-term care expenses in retirement, doing Roth conversions to save on taxes, or a hundred other strategies that may work for you,” he says. “Explaining things is one of my superpowers, and my goal is absolutely no surprises. My clients are all my friends. There is complete transparency about all fees, anticipated returns, and costs.”

”We answer to no one except our clients.”

— Collin LaFollette

Are we a fit for you? Let’s find out!

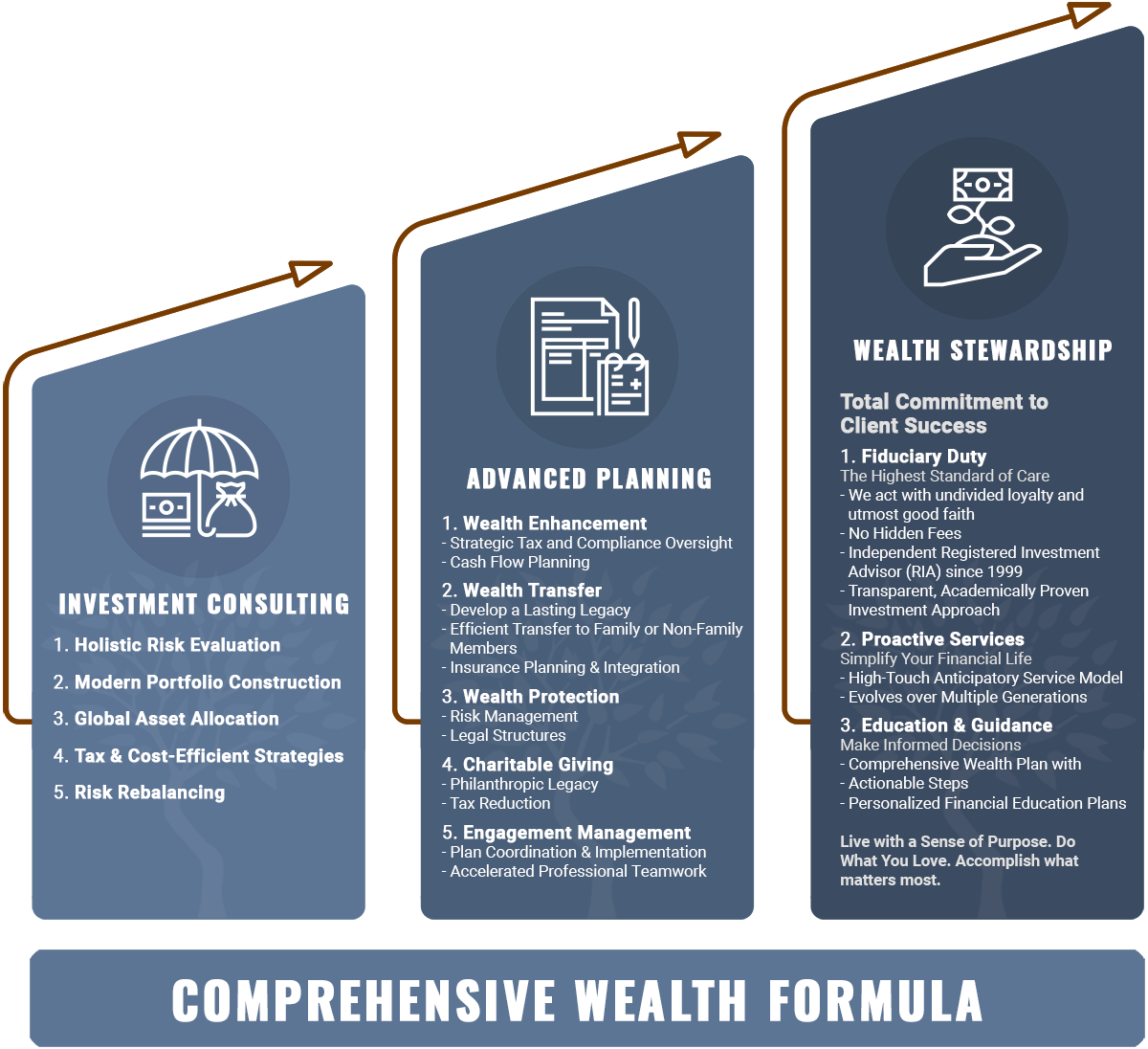

Investment Consulting

1. Holistic Risk Evaluation

2. Modern Portfolio Construction

3. Global Asset Allocation

4. Tax & Cost-Efficient Strategies

5. Risk Rebalancing

Advanced Planning

1. Wealth Enhancement

- Strategic Tax and Compliance Oversight

- Cash Flow Planning

2. Wealth Transfer

- Develop a Lasting Legacy

- Efficient Transfer to Family or Non-Family Members

- Insurance Planning & Integration

3. Wealth Protection

- Risk Management

- Legal Structures

4. Charitable Giving

- Philanthropic Legacy

- Tax Reduction

5. Engagement Management

- Plan Coordination & Implementation

- Accelerated Professional Teamwork

Wealth Stewardship

Total Commitment to Client Success

1. Fiduciary Duty

- We act with undivided loyalty and utmost good faith

- No Hidden Fees

- Independent Registered Investment Advisor (RIA) since 1999

- Transparent, Academically Proven Investment Approach

2. Proactive Services

- High-Touch Anticipatory Service Model

- Evolves over Multiple Generations

3. Education & Guidance

- Comprehensive Wealth Plan with Actionable Steps

- Personalized Financial Education Plans

- Live with a Sense of Purpose. Do What You Love. Accomplish what matters most

Get to Know Collin Personally

Collin was born in Canyon, Texas to a family of educators. His father had a master’s degree in education and was the athletic director at West Texas State (now West Texas A & M University.) His mother earned a bachelor’s degree and worked outside the home as a teacher’s aide. His half-brother, shown standing here at age 18 behind his mother, received his doctorate in education from Baylor. Both sisters have master’s in education degrees. Collin is shown here in his father’s arms.

Collin’s father moved the family to Carthage, Texas, when he became the principal at Carthage High School. After growing up in Carthage, Collin eventually moved to Searcy, Arkansas, to attend Harding University, where he received his bachelor’s degree in business administration and marketing in 1990.

Collin is extremely athletic like his father, who was 6’4” tall and had played college football, basketball and baseball. As a young man he was drafted by the New York Yankees to play in their farm system. (“I’m still a Yankees and, of course, Rangers fan,” Collin says.) Collin had played nearly every sport—football, baseball, basketball and golf—in high school. Originally receiving a scholarship after graduation to play baseball at a highly ranked Junior college, he soon decided he wanted to instead play golf at a university.

Always exhibiting an enterprising spirit and willingness to do things differently, Collin zeroed in on a small private university. “The golf coach at Harding was skeptical because they were so highly ranked—in fact, they were ranked 10th in the nation by the NAIA (National Association of Intercollegiate Athletics). I called him up out of the blue and had to do some convincing. I basically just asked him let me play a round with some of the best golfers on his team. The team members agreed, and they ended up making a spot for me.”

Collin remains passionate about golf to this day, and plays in competitive golf tournaments with Jackie, his wife and best friend. “I’m currently a 4 handicap,” Collin says. Musically inclined, he also enjoys singing in church as a tenor, and he plays rhythm guitar on occasion. He also enjoys watching sports, including of course, the Dallas Cowboys, Rangers and Yankees games. Collin is involved with his church, gives to local organizations and special projects, and plays golf in charity tournaments. As the youngest in his family, he has many nephews and nieces, including one nephew who’s close to his own age. “I love my extended family. It’s unique because my brother is 18 years older than I am, so I even have great-great nephews.” Collin and Jackie reside in Richardson, Texas.

How to Get Started with Bent Tree Trust Advisors

We want our first meeting with you to be as productive as possible and want you to receive beneficial information even if at the end of the meeting we decide we are not a good fit to work together. The first meeting is designed to be exploratory, and it’s complimentary. That said, the more we learn about you and your situation, the better we may be able to assess whether or not we can help you save money on taxes and grow your wealth now and for future generations.

Bent Tree Trust Advisors

3008 Holford Road

Richardson, TX 75082-3741

P: (972) 336-3362

F: (855) 743-4246

collin@benttreetrust.com