Pre-retirees & Retirees

At Bent Tree Trust Advisors, we have found that people preparing for retirement, whether married or single, need to create reliable retirement income streams, mitigate risks, and reduce their taxes. We can help by creating a comprehensive retirement plan that includes all income from investments, pensions, 401(k) or similar plans, and optimizing Social Security benefits. Protecting assets is critical during retirement, as is not allowing market risk to erode your portfolio. Having plans in place for the unexpected is important too, such as losing a spouse or developing the need for long-term care. And of course, transferring tax-advantaged wealth using estate planning strategies is part of our focus.

”Developing a reliable stream of income and mitigating taxes is critical in retirement.”

— Collin LaFollette

Are we a fit for you? Let’s find out!

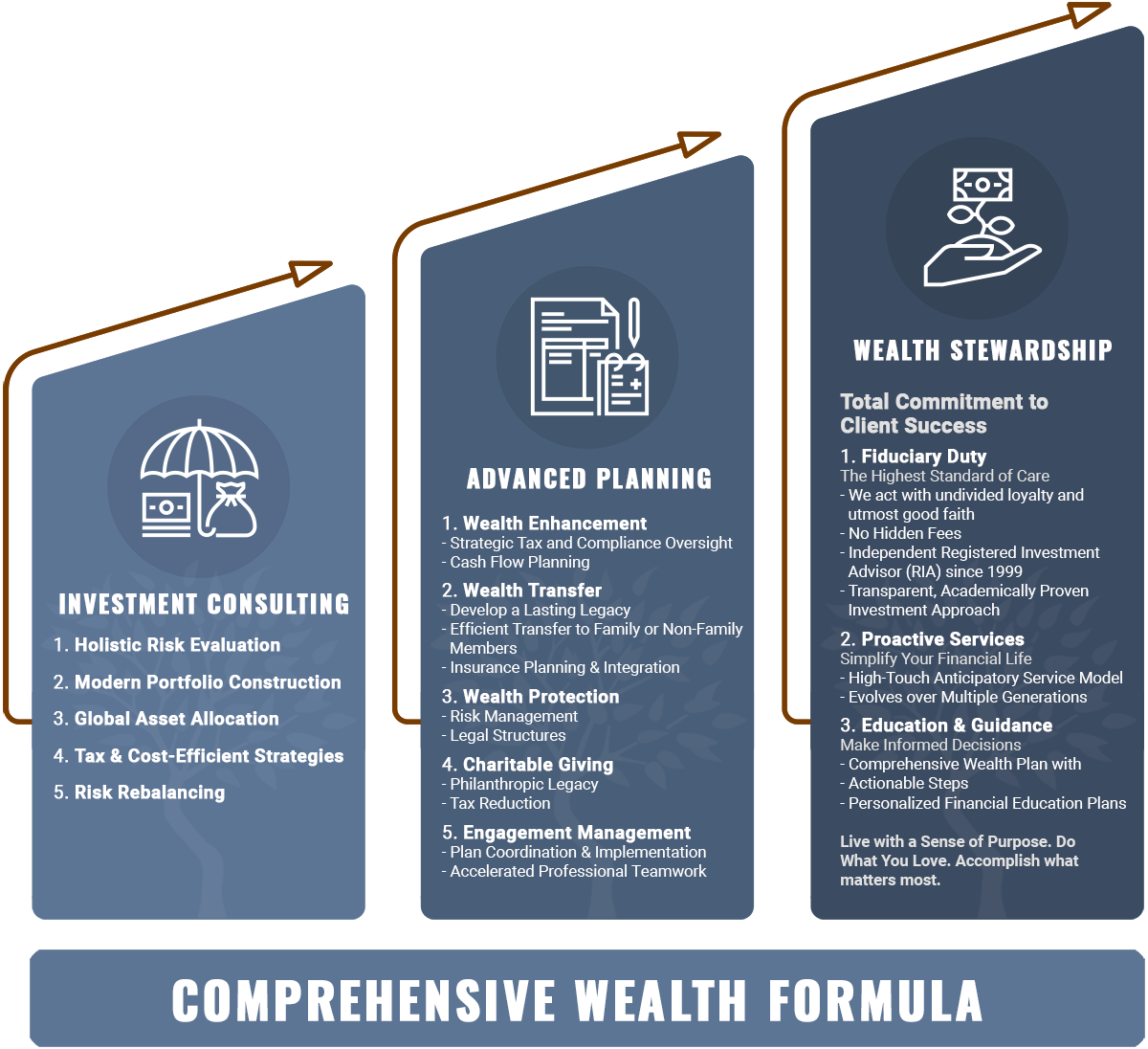

Investment Consulting

1. Holistic Risk Evaluation

2. Modern Portfolio Construction

3. Global Asset Allocation

4. Tax & Cost-Efficient Strategies

5. Risk Rebalancing

Advanced Planning

1. Wealth Enhancement

- Strategic Tax and Compliance Oversight

- Cash Flow Planning

2. Wealth Transfer

- Develop a Lasting Legacy

- Efficient Transfer to Family or Non-Family Members

- Insurance Planning & Integration

3. Wealth Protection

- Risk Management

- Legal Structures

4. Charitable Giving

- Philanthropic Legacy

- Tax Reduction

5. Engagement Management

- Plan Coordination & Implementation

- Accelerated Professional Teamwork

Wealth Stewardship

Total Commitment to Client Success

1. Fiduciary Duty

- We act with undivided loyalty and utmost good faith

- No Hidden Fees

- Independent Registered Investment Advisor (RIA) since 1999

- Transparent, Academically Proven Investment Approach

2. Proactive Services

- High-Touch Anticipatory Service Model

- Evolves over Multiple Generations

3. Education & Guidance

- Comprehensive Wealth Plan with Actionable Steps

- Personalized Financial Education Plans

- Live with a Sense of Purpose. Do What You Love. Accomplish what matters most

Starting Early to Mitigate Taxes In Retirement

Too many people still don’t understand that a large amount of money held in a traditional 401(k) will mean ordinary income taxes will have to be paid during retirement. (And keep in mind that that income taxes will be due from your heirs, too, if they inherit your 401(k).) You can’t just leave the money alone—it has to be withdrawn beginning at age 73 when annual RMDs (required minimum distributions) must be taken in the right amounts from the right accounts by December 31 each year per IRS rules. Even Social Security benefits can be taxed—up to 85% if your combined income calculation is higher than $34,000! We provide comprehensive retirement planning, and getting started early may afford you additional tax planning opportunities including Roth conversions.

How to Get Started with Bent Tree Trust Advisors

We want our first meeting with you to be as productive as possible and want you to receive beneficial information even if at the end of the meeting we decide we are not a good fit to work together. The first meeting is designed to be exploratory, and it’s complimentary. That said, the more we learn about you and your situation, the better we may be able to assess whether or not we can help you save money on taxes and grow your wealth now and for future generations.

Bent Tree Trust Advisors

3008 Holford Road

Richardson, TX 75082-3741

P: (972) 336-3362

F: (855) 743-4246

collin@benttreetrust.com